Moneta Markets Account Types in Malaysia

Introduction

Choosing the right Moneta Markets account type is an important step for traders in Malaysia who want to make the most of their strategy and risk tolerance. In this article, we take a simple and direct look at all Moneta Markets account types, ensuring you can pick the one that fits your goals best.

Overview of account styles

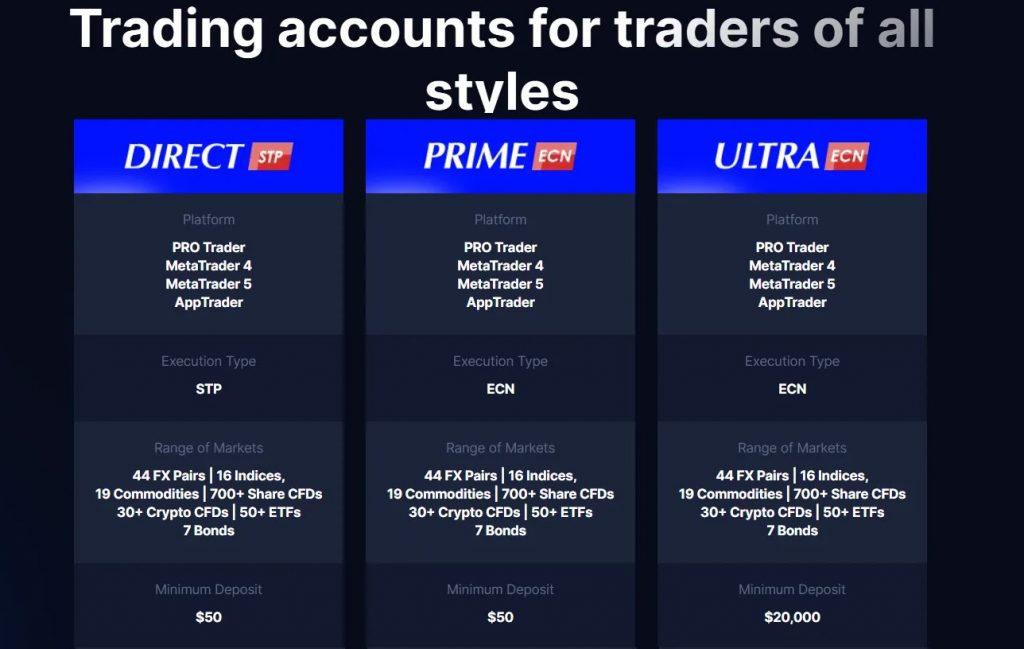

Moneta Markets offers three main live account types tailored to different experience levels and trading approaches:

- Direct STP – Designed for beginners, this account type features no commission and slightly wider spreads. It provides a simple way to start trading with low initial capital.

- Prime ECN – Suited for more active traders, especially those using scalping strategies or automated trading systems. It offers zero spreads and charges a commission per lot.

- Ultra ECN – Ideal for professionals and high-volume traders, this account delivers the most competitive pricing conditions but requires a higher initial deposit.

These Moneta Markets account types offer increasing levels of customization and cost-efficiency as your trading demands evolve.

Key account features comparison

| Account Type | Minimum Deposit | Spreads From | Commission (Per Side) | Leverage | Swap-free Option | Suitable For |

| Direct STP | USD 50 | 1.2 pips | USD 0 | Up to 1000:1 | Yes | Beginners |

| Prime ECN | USD 50 | 0.0 pips | USD 3 per lot | Up to 1000:1 | Yes | Scalpers, EA traders |

| Ultra ECN (Opt-in) | USD 20,000 | 0.0 pips | USD 1 per lot | Up to 1000:1 | Yes (with opt-in) | Professionals, fund managers |

Cost per lot comparison

| Account Type | EUR/USD Cost (Spread + Commission) |

| Direct STP | ~1.2 pips |

| Prime ECN | ~0.0 pips + USD 6 (round turn) |

| Ultra ECN | ~0.0 pips + USD 2 (round turn) |

Key differences

- Cost structure

- Direct STP: no commission, but wider spreads.

- Prime ECN: tight spreads from zero, USD 3 per lot per side.

- Ultra ECN: best pricing with just USD 1 per lot per side.

- Direct STP: no commission, but wider spreads.

- Funding requirements

- Direct & Prime ECN: starts from USD 50.

- Ultra ECN: minimum USD 20,000, opt-in required.

- Direct & Prime ECN: starts from USD 50.

- Trading style fit

- Direct STP: good for beginners learning the basics.

- Prime ECN: ideal for scalping and EA automation.

- Ultra ECN: designed for volume-based strategies.

- Direct STP: good for beginners learning the basics.

Description of each account

Direct STP gives easy entry for Malaysian traders with a USD 50 deposit and zero commission. It provides access to over 1,000 assets, 1000:1 leverage, and all platforms (MT4, MT5, ProTrader). Swap-free setup is available.

Prime ECN fits those who want lower spreads and don’t mind a small commission. Great for algorithmic traders and fast-moving markets.

Ultra ECN targets experienced traders with capital over USD 20,000. With just USD 1 commission per lot, it offers the best value for high-volume strategies.

Islamic (Swap-free) feature comparison

| Feature | Direct STP | Prime ECN | Ultra ECN |

| Swap-free Option | Available | Available | Available |

| Application Needed | Yes | Yes | Yes |

| Applies to All Assets? | No | No | No |

Non-trading fees

| Feature | Direct STP | Prime ECN | Ultra ECN |

| Swap-free Option | Available | Available | Available |

| Application Needed | Yes | Yes | Yes |

| Applies to All Assets? | No | No | No |

Which account suits who?

| Trader Profile | Recommended Account | Why it fits |

| New trader, learning basics | Direct STP | No commission; simple interface |

| Scalper or EA user | Prime ECN | Tight spreads; EA-friendly |

| Professional or big investor | Ultra ECN | Best pricing, lowest commissions |

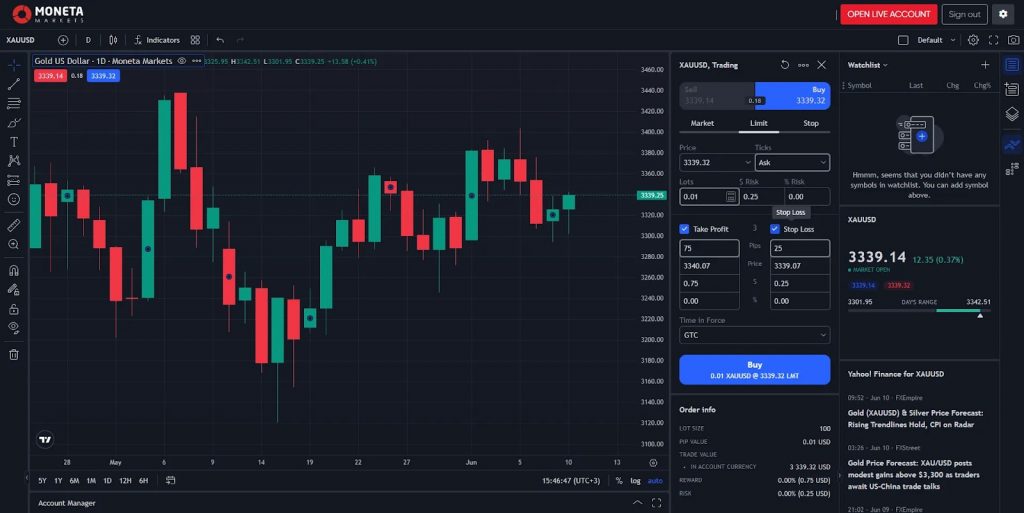

Trading platforms supported

All Moneta Markets account types support:

- MetaTrader 4 (MT4) – Popular platform with robust charting and expert advisors.

- MetaTrader 5 (MT5) – Enhanced features, including more timeframes and order types.

- ProTrader – Web-based platform with fast execution and clean interface.

These platforms are available across desktop, mobile, and web. All accounts have access to the same trading tools regardless of type.

Why Moneta Markets fits Malaysian traders

- Support for deposits in Malaysian Ringgit (MYR) through local payment partners.

- Full Islamic (swap-free) account functionality for Sharia-compliant trading.

- Region-specific support and onboarding for Malaysian users.

- High leverage (up to 1000:1) for all account types.

- No hidden fees on withdrawals or inactivity.

Conclusion

Your choice among the Moneta Markets account types depends on your trading goals and capital. Malaysian users benefit from local currency options, Islamic swap-free setups, and high leverage. Beginners should start with Direct STP, while active traders can get more value from Prime ECN. Those looking to commit larger capital can explore Ultra ECN and its powerful trading conditions.

FAQ

1. Can I change account types later?

You need to open a new account for a different type.

2. Is swap-free available in Malaysia?

Yes, all accounts can be made Islamic upon request.

3. Are MYR deposits accepted?

Yes, local funding options are supported through regional payment partners.

4. Is demo access available for each account type?

Yes, you can try Direct STP, Prime ECN, or Ultra ECN in demo mode.

5. Does Moneta charge withdrawal fees?

No, there are no withdrawal fees applied by Moneta Markets.